Lionel Ritchie and the Central Oregon Housing Market

I, like many others, enjoy Lionel Richie’s music. My appreciation probably began growing up in the early ’90s when my mother would put his hit “Dancing on the Ceiling” on the record player and turn up the volume. If you asked why she chose this song, I'd guess it was because of its quick tempo, likely to hype my sister and me up for our Saturday morning chores. Occasionally, the needle would snag, causing the record to skip and replay the same second or two until it was adjusted. This reminds me of the current state of the local housing market.

The local housing market is experiencing a similar repetitive pattern each month: owners are actively selling their homes, buyer activity remains sporadic. Many buyers are holding back due to high mortgage rates and affordability concerns. Although the "mortgage lockdown"—where owners hesitate to sell because of their low existing mortgage rates—is less pronounced than last year, the market is still stuck in a loop of cautious buyer behavior.

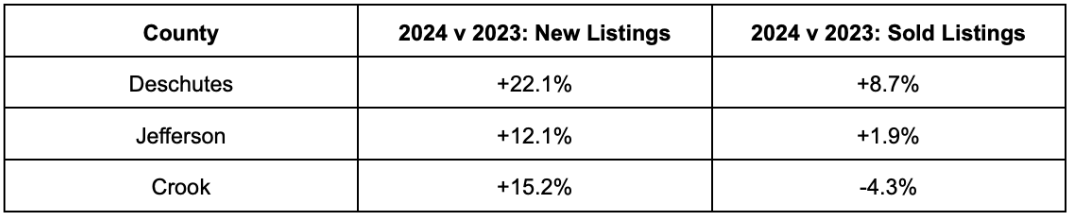

To illustrate the market dynamics across the three counties, here are the changes we’ve seen in the total numbers of new and sold homes from January 1 to May 31, 2024, compared to the same period last year:

“Insert record scratch sound effect”

It’s important to keep in mind that within these counties, especially Deschutes, each city is experiencing its own dynamics in these two categories. For example:

Like the necessary adjustment made to correct the skipping record, an adjustment will eventually come to the marketplace too. No, I'm not hinting at an impending crash, but rather an improvement in mortgage rates. When that happens continues to be the million-dollar question.

Until then:

If you’re looking to sell, you’re not alone. Simply putting a ‘for sale’ sign in the front yard isn’t enough to get a quick sale compared to a couple of years ago. Understanding the dynamics within your home’s price point is crucial. The question is not “whether or not it’s a good time to sell,” but rather “how does my home compare to similarly priced homes?” and “how has buyer activity shifted in my home's price point over the last 30 days?”

If you’re considering buying, it’s still possible, even with elevated rates. Homes at all price points are selling, and those purchasing them are having in-depth conversations with industry professionals about the financing tools and offer strategies to make it happen.

Whether you’re a buyer, seller, or just an avid market watcher, you might wonder if this imbalance will impact prices. The answer is: not significantly, at least not anytime soon. Homes are seeing price reductions to sell, but some are also receiving multiple offers. Generally, the average home experiences only a 1% reduction off its original sale price if it goes under contract between days 8 and 30 of being on the market.