What’s Next in 2024? Insights into the Rest of the Year

With the first 7 months of 2024 officially in the rear view mirror, let’s have a quick chat about what we could expect for the rest of the year.

At this moment, confidence is high that we’ll see our first rate cut at the Federal level (Federal Funds Rate) this September. Various economic reports show a steady economic slowdown. Unemployment recently reached 4.3% (the highest since October 2021), the inflation rate continues to improve, and both the manufacturing and services sectors are reporting an overall slowing down. It looks like we might actually be headed towards the economic 'soft landing' the Federal Reserve had been aiming for. Even though the rate cut decision is still 44 days away, the mortgage market has already seen solid improvement in rates. Last week alone, we saw rates drop back down into the mid-6%.

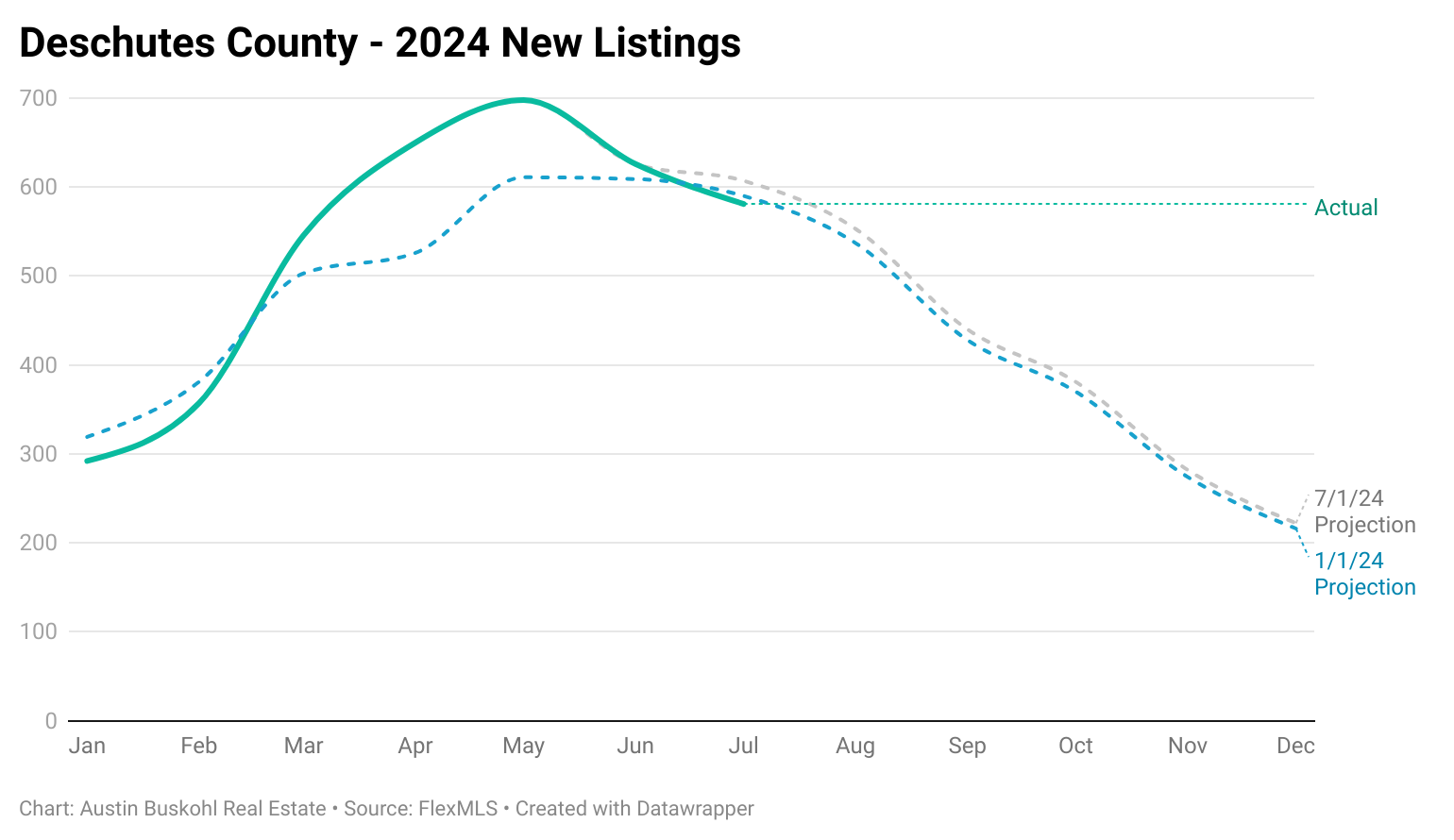

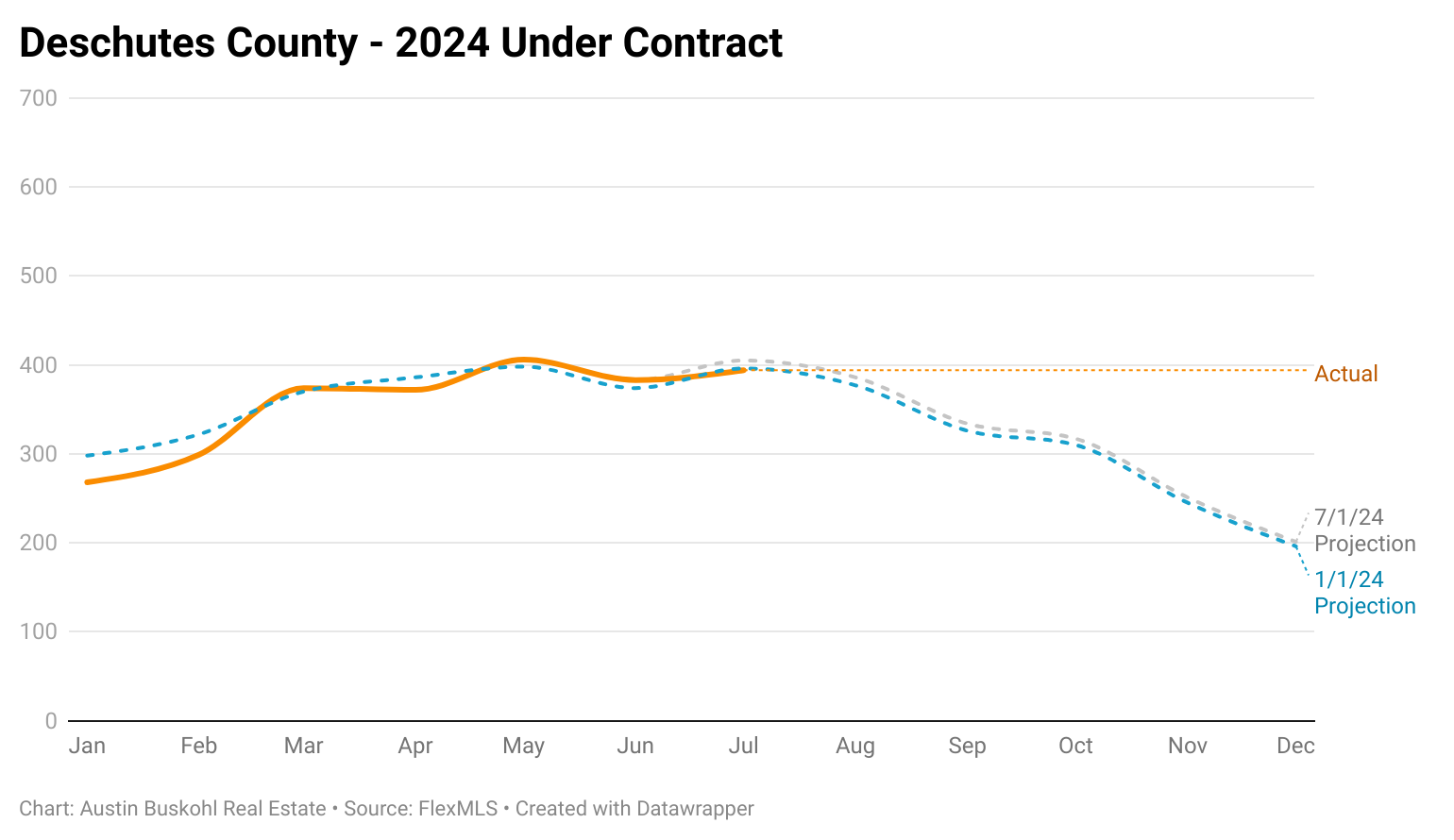

In the local housing market, we've reached that time of year when activity normally peaks, especially in terms of new inventory coming to market. At the county level, this peak occurred earlier than usual: May for Deschutes and Jefferson counties, and June for Crook County. Despite the earlier peaks in new inventory, buyer activity has remained mostly flat. As a result, we have continued to see available inventory grow this year. With that inventory growth, and a basic understanding of supply and demand, leads me nicely into the obvious next topic…prices.

As supply grows, prices usually come down...usually. To keep it brief as to why we aren't see prices soften, it comes down to who is buying and, more importantly, the tools being used to buy a home instead of any drastic price reduction. You might be thinking, "I see price reductions all the time, Austin," and I wouldn't disagree. However, at its peak, only 10% to 15% of the Bend and Redmond markets experience price reductions in any given week, with the surrounding areas seeing even less. And if you're curious about how much of a reduction it takes on average to sell a house in 2024, you can find more details in my most recent post on either Facebook or LinkedIn.

With all that knowledge now, what could the rest of 2024 look like?

Middle of the Road Estimate: The market follows its typical seasonal trend, and we end the year with more available inventory than we started with, along with continued stabilized prices.

Optimistic Estimate: We see continued improvements in mortgage rates over the last five months, leading to a potential late surge in activity due to improved affordability (from a rate standpoint).

Pessimistic Estimate: The economy slows down much faster than expected, resulting in some level (probably mild) of a recession.

My money is somewhere between middle of the road and the high estimate